- KPA Wealth Weekly

- Posts

- Will the Fed Cut Rates? Market Signals, Home Prices, and Smart Money Moves This Week

Will the Fed Cut Rates? Market Signals, Home Prices, and Smart Money Moves This Week

Get the latest on rate expectations, slowing home prices, AI tools for business, and where smart investors are shifting.

Welcome back to KPA Wealth. This week, we're navigating a market hinting at softness, but still far from a Fed rate cut. Mortgage rates are easing, but buyer caution remains key as economic data and Fed speak create mixed signals. Home price trends are flattening out, offering insight for both investors and first-time buyers.

Also Today: We’ll also dig into a hidden market mover: defense demand for silver, and how that impacts SLV. Plus, we’re looking at a new tool for realtors and entrepreneurs—Google’s Imagen 4—and how it’s revolutionizing the way we create and use visuals in business.

📉 Market Update: A Softening Market... But Don’t Bet on a July Rate Cut Just Yet

Stocks and mortgage bonds kicked off the week with strength—boosted by reports of a ceasefire between Israel and Iran and a wave of optimism around possible rate cuts from the Fed.

But let’s be real...

Will there be a Rate Cut or is it Just Wishful Thinking?

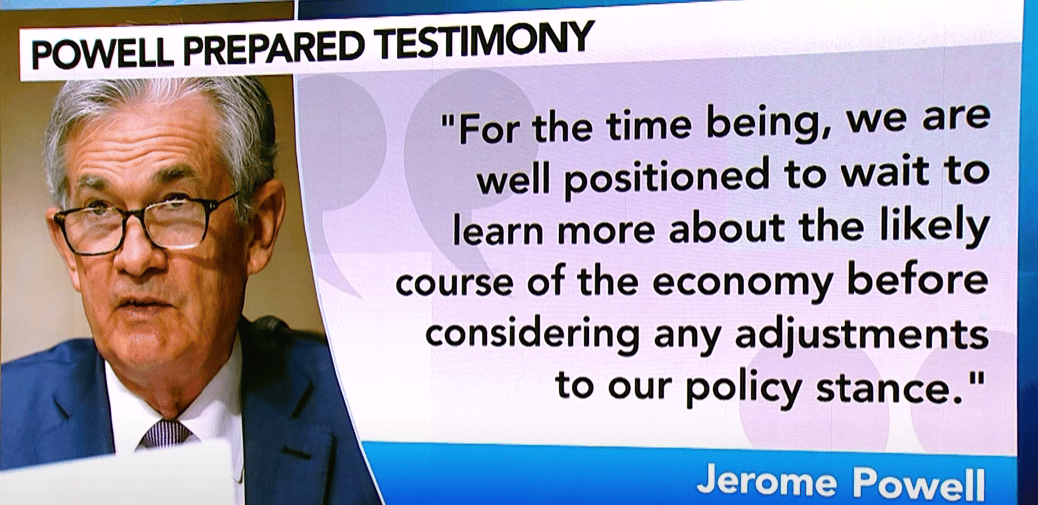

Some Fed officials are starting to change their tone. Chicago Fed President Goolsbee and Governor Bowman both made comments that suggest the door to rate cuts is at least cracked open—especially if inflation continues to moderate.

But here’s where I raise an eyebrow…

Despite the headlines, the CME FedWatch Tool is only pricing in a 24% chance of a rate cut at the July meeting. In other words: the bond market isn’t buying the hype just yet.

If you’re in the market for a home, I’d plan based on where rates are—not where we hope they might go.

🏠 Home Price Trends: Seasonally Adjusted Prices Show a Pullback

The Case-Shiller Home Price Index—arguably the most respected gauge of national home values—gave us a split read in April:

Unadjusted: Prices rose 0.6%, but that’s par for the course during spring.

Seasonally Adjusted: Prices actually fell 0.4%, which is more telling of the true trend beneath the seasonal buzz.

Year-over-year price appreciation is also decelerating:

National Index: +2.7% (down from 3.4%)

10-city Composite: +4.1%

20-city Composite: +3.4%

The FHFA index, which looks only at homes with conforming loans (excluding cash and jumbo deals), also showed a 0.4% monthly drop and a +3.0% annual gain, down from 3.9%.

We're still seeing growth—but the trajectory is clearly slowing.

📅 What to Watch This Week

Several key economic reports could nudge mortgage rates in either direction:

Thursday: Durable Goods Orders, Jobless Claims, Final Q1 GDP, Pending Home Sales

Friday: PCE (Personal Consumption Expenditures) — the Fed’s go-to inflation gauge

These numbers may either reinforce the “rate cuts are coming” narrative or throw more cold water on it. We will update and adjust our projection on Friday depending on if PCE numbers come in hot or cold.

🔥 Google’s Imagen 4 Is Changing the Game for Visual Content — Here's How I'm Using It

Google just dropped Imagen 4, its most powerful text-to-image AI model yet—and I’ve already started thinking about how this can make life easier (and marketing sharper) for realtors and business owners.

Imagen 4 is now live in Google AI Studio and the Gemini API, and let me tell you—this thing can generate stunning visuals and realistic text inside images (a big leap from previous models). It comes in two versions:

Imagen 4: The workhorse—great for almost anything, and only $0.04 per image

Imagen 4 Ultra: More accurate, more cinematic, and more obedient to your prompts—$0.06 per image

I tested some prompts and this thing spits out postcard-worthy landscapes, luxury interiors, and even fashion editorial shots that look like they came out of a magazine. You can literally say “modern farmhouse kitchen with marble countertops, natural light, and staging for a $1.2M listing” and it gives you an image you could use in a listing teaser.

💼 How Realtors & Entrepreneurs Can Use Imagen 4:

Mock up listing photos for renovations, pre-construction, or dream home ads

Design Instagram posts with clean, branded visuals and embedded text

Create marketing assets on the fly—no designer needed

Build lifestyle branding (think: "young couple enjoying coffee in their new home")

With more and more of our content being AI-driven, Imagen 4 makes it faster and cheaper to stay creative and professional.

Imagen 4 is currently available in the Gemini API and Google AI Studio.

Silver & SLV: The Perfect Inflation Hedge — Now with Defense Demand

In 2025, silver remains one of the most compelling hedges against inflation — and its strategic value is only gaining traction. From a macroeconomic standpoint, slackening real yields and a dovish Federal Reserve outlook are fundamental drivers pushing industrial and precious metals higher. Silver, in particular, combines inflation protection with rising industrial utility — solar panels, 5G, EVs, and even defense systems all demand it.

Recent news adds another layer: some military-grade missiles contain astonishing amounts of silver. Reports suggest a Tomahawk cruise missile includes about 500 ounces (~15 kg), and Patriot interceptors may carry roughly 1.5 k. With Iran firing ballistic volleys and Israel responding — demand for silver in military tech has surged.

That’s where SLV shines. Backed by physical silver, iShares Silver Trust (SLV) offers liquid, low-cost exposure — without the storage headaches. With industrial use, strategic defense demand, and inflationary pressure all converging, both silver and SLV offer an undervalued, dual-purpose play.

Bottom line: Now is a powerful moment to consider silver or SLV — not just for inflation protection, but for exposure to surging strategic demand from defense systems.

🏠 Today’s Mortgage Rates

🚀 Must-Have AI Tools for Real Estate & Financial Pros

Check out our Top 30 AI Tools for Real Estate, Finance, and Investment

Kyle Allgair

CEO of KPA Wealth

📞 (279) 977-8149 | ✉️ [email protected]

🌐 KPAhomeloans.com

Kyle Allgair is the CEO of KPA Wealth, and is continuously helping clients build wealth through real estate and strategic financial planning. Contact him for personalized advice on achieving your financial goals.